Cyprus is on the path to economic recovery, with the IMF projecting a decrease in public debt ratio to 70.7% this year and aiming to reach the 60% mark by 2026. The tourism sector is flourishing, with a 9.8% increase in arrivals, while the Cyprus Stock Exchange reflects investor confidence and economic vigor with its recent growth.

What is the economic outlook for Cyprus according to the IMF and recent market developments?

The IMF projects Cyprus’ public debt to GDP ratio to fall to 70.7% in 2023 and reach the Maastricht Treaty threshold of 60% by 2026. Tourism shows resilience with a 9.8% increase in arrivals, and the Cyprus Stock Exchange exhibits growth, reflecting investor confidence and economic vigor.

Cyprus Debt Forecast: A Positive Outlook from the IMF

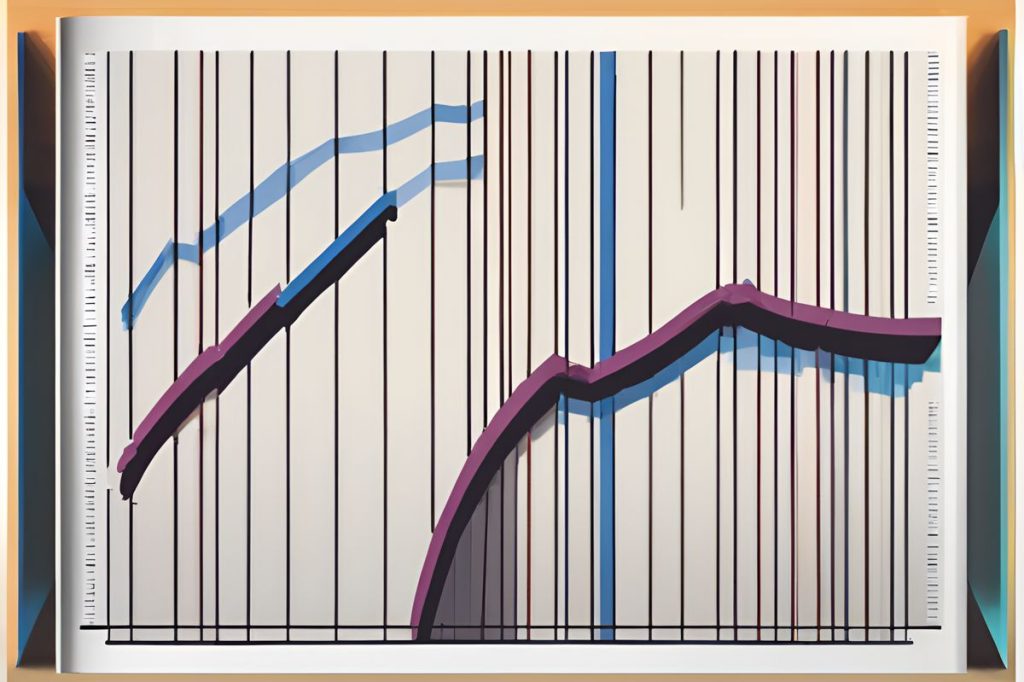

Finance Minister Makis Keravnos has expressed his positivity regarding Cyprus’ financial projections as reported by the IMF’s Fiscal Monitor. The IMF anticipates that Cyprus’ public debt ratio will fall to the Maastricht Treaty’s threshold of 60% sooner than expected. The debt-to-GDP ratio for Cyprus is projected to drop to 70.7% this year, showing improvement from the previous year’s 71.9%. By 2025, a further decrease to 65.1% is expected, marking a sign of economic recovery and fiscal responsibility.

The downward trend is set to continue, with forecasts placing the debt ratio at the 60% benchmark in 2026, and then further decreasing to 56%, 52.8%, and 50% in the subsequent years. Keravnos highlighted that these developments are particularly notable given the current geopolitical challenges. He remains cautiously optimistic, hoping for stability and no additional geopolitical strains that could affect the economic climate.

Stock Exchange and Capital Markets Evolution

A landmark achievement for the financial landscape of Cyprus has been the successful dual-listing of Euro Medium Term Notes (EMTN) of the Republic of Cyprus at the Cyprus Stock Exchange. This operation is the result of a collaboration between the Finance Ministry, SIX (a leading financial market infrastructure provider), and the Cyprus Stock Exchange (CSE). This initiative commenced trading on March 27, 2024, and it represents a significant step in enhancing the CSE’s role as the Central Securities Depository.

SIX’s contribution to this project includes a post-trade solution tailored to support the CSE in handling the safekeeping, settlement, and servicing of these financial instruments. The partnership is aimed at increasing liquidity for the Republic of Cyprus’ funding vehicles, fostering the growth of the Cypriot capital markets, and capturing long-term value for both the CSE and SIX.

Tourism and Construction: Signs of Economic Vigor

Despite regional tensions in the Middle East, Cyprus’ tourism sector has demonstrated resilience, with ACTA’s press spokesman, Antonis Orthodoxou, reporting a robust start to 2024. Statistics from the Cyprus Statistical Service reveal a 9.8% increase in tourist arrivals in March compared to the previous year, with a total of 202,256 visitors. The quarter ending in March saw an overall 5.4% rise in tourist numbers, suggesting a stable and growing appeal of Cyprus as a vacation destination.

In the construction sector, the price index for materials has seen fluctuations, indicative of the changes in the industry. As of March, the index stood at 117.19 units, with a slight increase from the prior month. However, when juxtaposed with last year’s data, there’s a noticeable decrease of 1.70%. These metrics are essential for understanding the dynamics of the construction market and its influence on the broader Cypriot economy.

Cyprus Stock Exchange: A Snapshot of Recent Performance

The CSE ended a trading day with gains, showcasing investor confidence. The general index showed a modest increase of 0.55%, with similar growth reflected in the FTSE / CySE 20 Index. The total value of transactions for the day marked a substantial €149,223. Sector-wise, the main and alternative indexes increased by 0.4% and 0.63%, respectively. The hotel industry remained stable, while investment firms experienced a slight drop.

Investors showed particular interest in companies like Vassiliko Cement Works Public Company, with a notable rise in stock value. Meanwhile, other major players like the Bank of Cyprus and Hellenic Bank also experienced gains, contributing to the positive sentiment surrounding the CSE and the financial growth potential of Cyprus.

What is the economic outlook for Cyprus according to the IMF and recent market developments?

The IMF projects Cyprus’ public debt to GDP ratio to fall to 70.7% in 2023 and reach the Maastricht Treaty threshold of 60% by 2026. Tourism shows resilience with a 9.8% increase in arrivals, and the Cyprus Stock Exchange exhibits growth, reflecting investor confidence and economic vigor.

What are the debt forecasts for Cyprus and how are they expected to evolve in the coming years?

The IMF anticipates Cyprus’ public debt ratio to drop to 70.7% in 2023 and reach the 60% threshold by 2026. Further reductions are expected in the subsequent years, with projections of 65.1% in 2025, 56% in 2027, 52.8% in 2028, and 50% in the following years.

How has the Cyprus Stock Exchange evolved recently and what are some significant developments in the capital markets?

The Cyprus Stock Exchange recently saw growth and investor confidence, with gains in the general index, FTSE / CySE 20 Index, and total transaction value. A significant development is the successful dual-listing of Euro Medium Term Notes (EMTN) of the Republic of Cyprus, enhancing the CSE’s role as the Central Securities Depository.

What are the recent trends in Cyprus’ tourism sector and the construction industry?

Cyprus’ tourism sector has shown resilience with a 9.8% increase in arrivals, indicating growth and stability. In the construction industry, there have been fluctuations in the price index for materials, with a slight increase compared to the previous month but a decrease compared to the previous year. These trends provide insights into the economic vigor and dynamics of the Cypriot economy.