Cyprus Non-Performing Loans: A Steady Economic Indicator

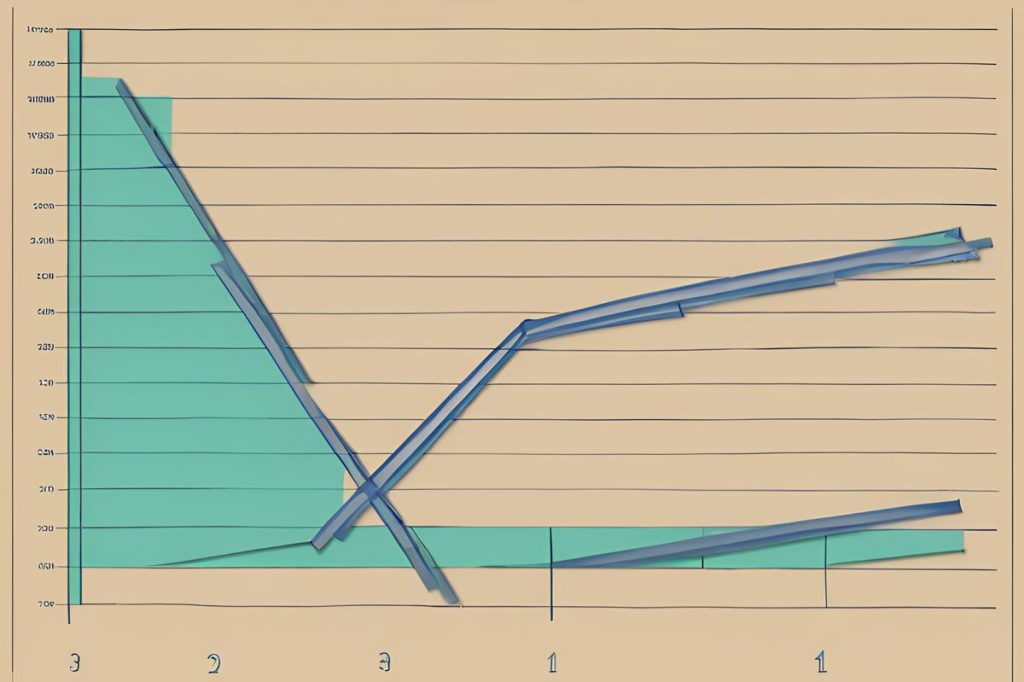

Nonperforming loans in Cyprus hold steady at €1.77 billion, with a stable NPL ratio of 7.4 percent, reflecting the banking sector’s resilience in managing credit risk and supporting customers through restructured agreements amid economic challenges. The consistent figures from the Central Bank of Cyprus reveal a banking sector adapting to fluctuating financial circumstances while maintaining transparency and trust, offering a grounded perspective on the health of Cyprus’ financial landscape.